Introduction

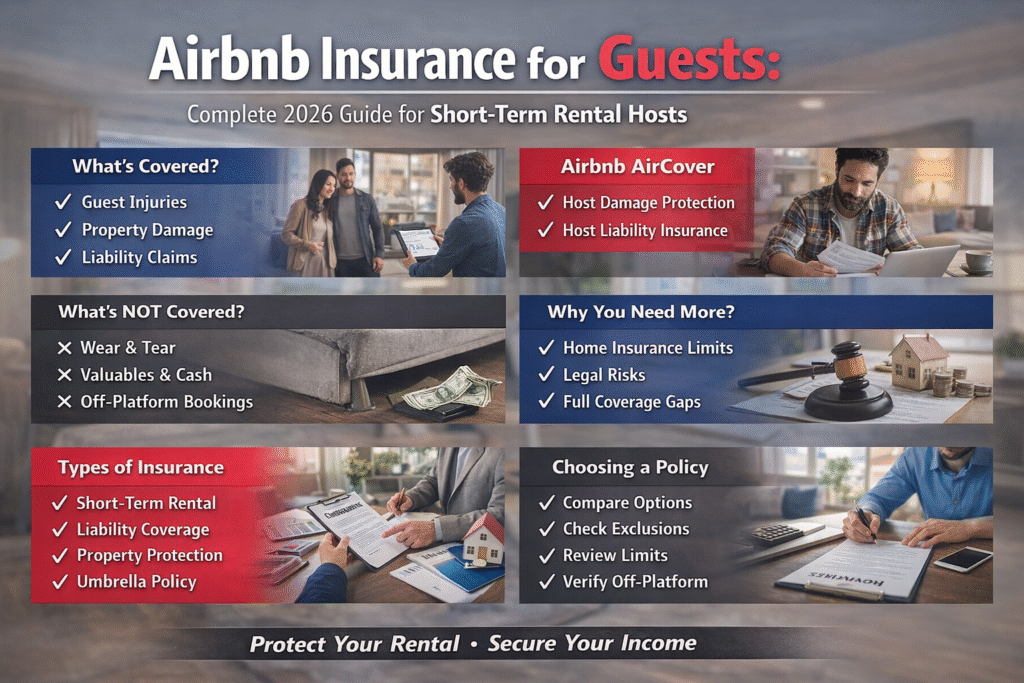

If you are running a short-term rental business in 2026, understanding Airbnb insurance for guests is no longer optional. Whether you manage one apartment or multiple vacation rentals, insurance protection is critical to safeguard your property, your income, and your guests.

Many short-term rental hosts believe that standard homeowner insurance is enough. However, traditional policies often exclude commercial activity such as Airbnb hosting. That is why having the right short-term rental insurance coverage is essential.

In this complete 2026 guide, we will explain:

- What Airbnb insurance for guests covers

- How Airbnb’s built-in protection works

- What it does not cover

- Why hosts still need additional insurance

- How to choose the best vacation rental insurance policy

This SEO-friendly guide is designed to help property owners, travel hosts, and rental managers protect their business properly.

What is Airbnb Insurance for Guests?

Airbnb insurance for guests refers to insurance protection that applies when a guest stays at your short-term rental property and something goes wrong.

This can include:

- Guest injury inside the property

- Property damage caused by guests

- Liability claims

- Accidental damage to furniture or appliances

- Legal expenses related to claims

For short-term rental hosts, this protection reduces financial risk and legal exposure.

However, many hosts misunderstand how Airbnb protection works. It is important to clearly understand the difference between:

- Airbnb’s built-in protection programs

- Host protection insurance

- Third-party vacation rental insurance policies

Understanding Airbnb’s Built-In Protection Programs

1. Airbnb AirCover for Hosts

Airbnb offers a protection program called AirCover for Hosts. This includes:

- Host Damage Protection

- Host Liability Insurance

Host Damage Protection

This covers:

- Damage caused by guests to your property

- Damage to furniture, appliances, or décor

- Lost income due to guest-caused cancellation

Coverage limit: Up to $3 million (subject to conditions and region).

Host Liability Insurance

This covers:

- Guest injury claims

- Property damage claims made by guests

- Legal defense costs

Coverage limit: Up to $1 million per occurrence.

What Airbnb Insurance Does NOT Cover

While Airbnb provides strong protection, it does not replace comprehensive vacation rental insurance.

Common exclusions include:

- Normal wear and tear

- Cash and valuable items

- Intentional damage by host

- Off-platform bookings

- Certain natural disasters

- Shared areas in some buildings

This is why experienced short-term rental hosts invest in dedicated Airbnb host insurance policies.

Why Standard Home Insurance is Not Enough

Most traditional homeowner policies exclude business activity. Hosting guests on Airbnb is considered commercial use.

If you rely only on home insurance:

- Your claim may be rejected

- Your policy may be canceled

- You may face legal liability personally

That is why a proper short-term rental insurance policy is essential for risk management.

Types of Insurance Short-Term Rental Hosts Need

1. Short-Term Rental Insurance

Specifically designed for Airbnb hosts. Covers:

- Property damage

- Guest liability

- Loss of rental income

- Vandalism

2. Commercial Property Insurance

If you operate multiple properties, this is recommended.

3. General Liability Insurance

Protects against:

- Bodily injury claims

- Third-party property damage

- Legal expenses

4. Umbrella Insurance Policy

Provides extra liability coverage beyond your main policy limits.

Key Coverage Features to Look for in 2026

When choosing Airbnb insurance for guests, look for these features:

Guest Injury Coverage

Covers medical bills if a guest slips or gets injured inside your property.

Property Damage Protection

Protection for furniture, electronics, kitchen appliances, and interiors.

Loss of Income Coverage

If your property becomes unlivable after damage, this compensates lost booking revenue.

Legal Expense Coverage

Covers attorney fees and court costs.

Natural Disaster Coverage

Protection from fire, flood, storm, or earthquake (depending on policy).

Real-World Example

Imagine a guest slips in the bathroom and files a lawsuit for medical expenses.

Without proper insurance:

- You may pay hospital bills

- You may pay legal defense fees

- You may lose rental income

With proper short-term rental liability insurance:

- Insurance covers medical and legal costs

- Your personal savings remain protected

- Your business continues smoothly

Cost of Airbnb Insurance in 2026

Insurance cost depends on:

- Property location

- Property value

- Number of bookings per year

- Coverage limits

- Claims history

Average estimated cost:

- $500 to $2,500 per year (for single property hosts)

- Higher for luxury or high-risk areas

Investing in proper coverage is far cheaper than paying a major lawsuit claim.

How to Choose the Best Airbnb Insurance Policy

Follow this step-by-step approach:

- Review your existing homeowner policy

- Check Airbnb AirCover details

- Compare short-term rental insurance providers

- Ask about exclusions clearly

- Verify liability coverage limits

- Ensure coverage for off-platform bookings

Common Mistakes Hosts Make

- Assuming Airbnb covers everything

- Not reading policy exclusions

- Choosing the cheapest insurance

- Ignoring liability risks

- Not updating coverage when property value increases

Avoid these mistakes to protect your rental business long-term.

SEO Tips for Short-Term Rental Hosts

If you operate a travel or rental website like emkaytravelsolution.com, adding a detailed insurance guide improves:

- Organic traffic

- Topical authority

- E-E-A-T signals

- Trust with property owners

Using keywords like:

- Airbnb insurance for guests

- Short-term rental insurance 2026

- Vacation rental liability coverage

- Host protection insurance

- Airbnb host insurance policy

helps improve ranking in competitive travel niches.

Frequently Asked Questions

Is Airbnb insurance enough for hosts?

No. Airbnb provides strong protection, but it does not replace a dedicated short-term rental insurance policy.

Does Airbnb cover guest theft?

Coverage is limited. Valuable items and cash are usually excluded.

Do I need insurance for one property?

Yes. Even one short-term rental property carries liability risk.

Is short-term rental insurance mandatory?

It may not be legally required everywhere, but it is strongly recommended.

Final Thoughts

Running a short-term rental in 2026 requires more than great hospitality. It requires strong financial protection.

Airbnb insurance for guests is a critical part of protecting your rental business from lawsuits, property damage, and unexpected financial loss.

While Airbnb’s AirCover program provides a helpful safety net, professional hosts understand the importance of having dedicated short-term rental insurance coverage.

Follow Us Now: Facebook | Instagram

You May Also Like:

Same Day Agra Tour from Delhi | Private Taj Mahal Tour | Agra City Tour Package | Taj Mahal Sunrise Tour | Half-Day Delhi Sightseeing Tour | Golden Triangle Tour India